🧠 AI Quiz

Think you really understand Artificial Intelligence?

Test yourself and see how well you know the world of AI.

Answer AI-related questions, compete with other users, and prove that

you’re among the best when it comes to AI knowledge.

Reach the top of our leaderboard.

AlphaWiseWin

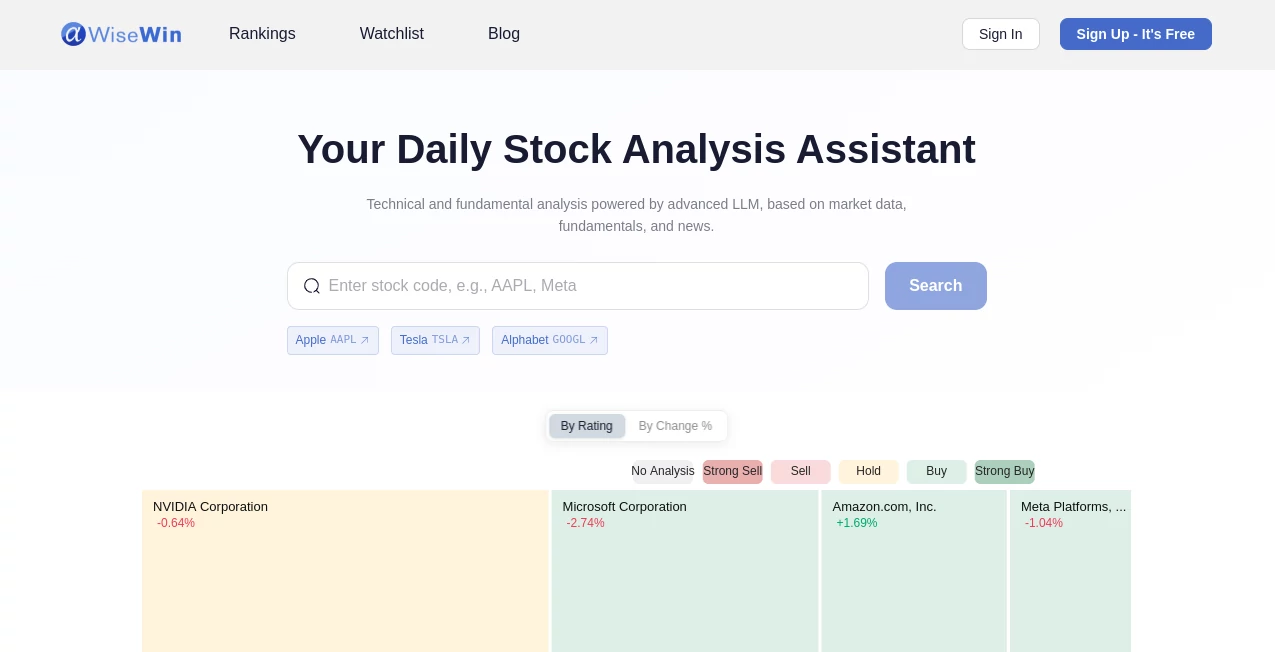

What is AlphaWiseWin?

Imagine having a sharp-minded advisor in your pocket, one who's crunched the numbers on thousands of trades and spots patterns you might miss in the heat of the market. That's the magic at play here—a platform that feels like chatting with a seasoned fund manager who's always one step ahead. I've seen friends light up when they share how it turned a hunch into a solid pick, pulling together data points that would've taken them hours to chase down. It's not just about the wins; it's that quiet confidence it builds, letting you focus on the big picture while it handles the details.

Introduction

Picture this: you're scrolling through earnings reports late at night, second-guessing every dip and surge, when suddenly you have a tool that sifts through the noise like a pro. Born from the minds of veteran fund managers and AI whizzes, this platform steps in as your go-to for making sense of the stock world. No more staring at spreadsheets until your eyes cross—it's all about real-time insights that feel personal, tailored to your style whether you're a cautious long-term holder or chasing those quick flips. What hooked me early on was how it bridges the gap between Wall Street smarts and everyday investing, turning overwhelming data into actionable nudges that actually pay off. Over coffee with a buddy who's been using it for months, he swore it shaved weeks off his research routine, and honestly, after trying it, I get the hype.

Key Features

User Interface

The dashboard hits you like a well-organized trading floor—clean lines, intuitive charts that load without a glitch, and a sidebar that anticipates your next move. Whether you're on desktop or mobile, it adapts seamlessly, with drag-and-drop heatmaps that let you zoom into sectors without fumbling through menus. It's that rare setup where everything's where you'd expect it, almost like it reads your mind before you click. One user I chatted with called it "the least annoying screen in my workflow," and coming from a guy who juggles ten tabs at once, that's high praise.

Accuracy & Performance

When it comes to nailing the details, this thing shines—drawing from vast datasets to deliver predictions that hold water, often spotting trends days before they blow up in the news. Speeds are snappy too; real-time updates roll in without lag, even during market rushes, keeping you ahead without the frustration of stale info. I've watched it flag a sentiment shift in a biotech stock that turned out spot-on, saving a portfolio from a rough patch. It's not flawless—no tool is—but the reliability here feels like a trusty co-pilot, one you can lean on without second-guessing.

Capabilities

From fundamental breakdowns that peel back earnings layers to technical scans that highlight breakout patterns, it covers the bases with sentiment analysis thrown in for that emotional edge the market loves. Smart picks bubble up based on your risk tolerance, and those heatmaps? They're a revelation, coloring hot sectors in ways that make opportunities jump out. Throw in industry deep dives, and you've got a full toolkit for everything from quick scans to long-haul strategies. It's like having a research team on speed dial, dishing out insights that feel custom-crafted every time.

Security & Privacy

In a space where data's king, this platform treats yours like the crown jewels—encrypted end-to-end, with strict access controls that keep prying eyes at bay. No sneaky data shares or hidden fees; it's all about giving you peace of mind while you plot your next move. Users I've talked to appreciate how it logs sessions transparently, so you're always in the loop without the paranoia. It's that solid foundation that lets you dive deep, knowing your edge stays yours alone.

Use Cases

Solo investors use it to vet weekend watches, turning vague ideas into vetted buys that align with their goals. Day traders lean on the live heatmaps for those split-second calls, while retirees sift through dividend darlings with ease. I've heard from a small business owner who pairs it with quarterly reviews, spotting sector shifts that inform everything from vendor picks to expansion plans. It's versatile like that—scaling from casual checks to serious portfolio overhauls, always delivering that "aha" moment when you least expect it.

Pros and Cons

Pros:

- Blends pro-level analysis with user-friendly vibes that don't overwhelm.

- Real-time everything keeps you in the loop without constant refreshes.

- Custom alerts that feel thoughtful, not spammy.

- Backed by real fund expertise, so the advice carries weight.

Cons:

- Best with some market know-how; total newbies might need a gentle ramp-up.

- Focuses heavy on U.S. plays, so global hunters may want supplements.

Pricing Plans

It starts with a free tier that's generous enough to hook you—basic scans and a taste of the heatmaps to whet your appetite. From there, monthly subs climb reasonably, unlocking full analytics and unlimited picks for around what you'd spend on a decent lunch out. Premium tiers add team shares and deeper reports, with annual deals that sweeten the pot. No lock-ins, easy pauses, and that trial period? It's a no-brainer way to see if it clicks with your routine.

How to Use AlphaWiseWin

Sign up in a snap, link your watchlist, and start by punching in a ticker—watch as it unpacks the story with charts and calls. Set your filters for risk or sector, let the alerts ping your phone for moves, and tweak as you go. It's that straightforward loop: input curiosity, get clarity, act with confidence. My tip? Start small with a sector scan; it'll show you the ropes while uncovering gems you didn't know to chase.

Comparison with Similar Tools

Stack it against the big names, and it stands out for that fund-manager polish—less hype, more substance, without the bloated fees or clunky interfaces that bog others down. Where some flood you with noise, this one curates the signal, making it the smarter pick for folks who value depth over dazzle. It's like upgrading from a flip phone to a smartphone: suddenly, everything just works better, faster, and with way less hassle.

Conclusion

At the end of the day, this platform isn't about chasing every trend—it's about arming you with the smarts to pick winners that fit your life. It turns the guessing game into a guided path, blending cutting-edge tech with timeless investing wisdom in a way that's downright empowering. If you're ready to trade overwhelm for opportunity, dive in; you might just find it's the edge that's been missing from your portfolio all along.

Frequently Asked Questions (FAQ)

Is it beginner-friendly?

Absolutely—start with the basics, and it'll grow with you, explaining terms as you explore.

What markets does it cover?

Primarily U.S. equities, with spot-on coverage for the stocks that matter most to everyday investors.

Can I integrate it with my broker?

Yes, seamless links to major platforms keep your workflow tight and trades timely.

How often are the insights updated?

Real-time during hours, with overnight digests to kick off your day right.

Any guarantees on performance?

It's about informed choices, not crystal balls—but the track record from its creators speaks volumes.

AI Investing Assistant , AI Research Tool , AI Analytics Assistant .

These classifications represent its core capabilities and areas of application. For related tools, explore the linked categories above.

AlphaWiseWin details

This tool is no longer available on submitaitools.org; find alternatives on Alternative to AlphaWiseWin.

Pricing

- Free

Apps

- Web Tools