🧠 AI Quiz

Think you really understand Artificial Intelligence?

Test yourself and see how well you know the world of AI.

Answer AI-related questions, compete with other users, and prove that

you’re among the best when it comes to AI knowledge.

Reach the top of our leaderboard.

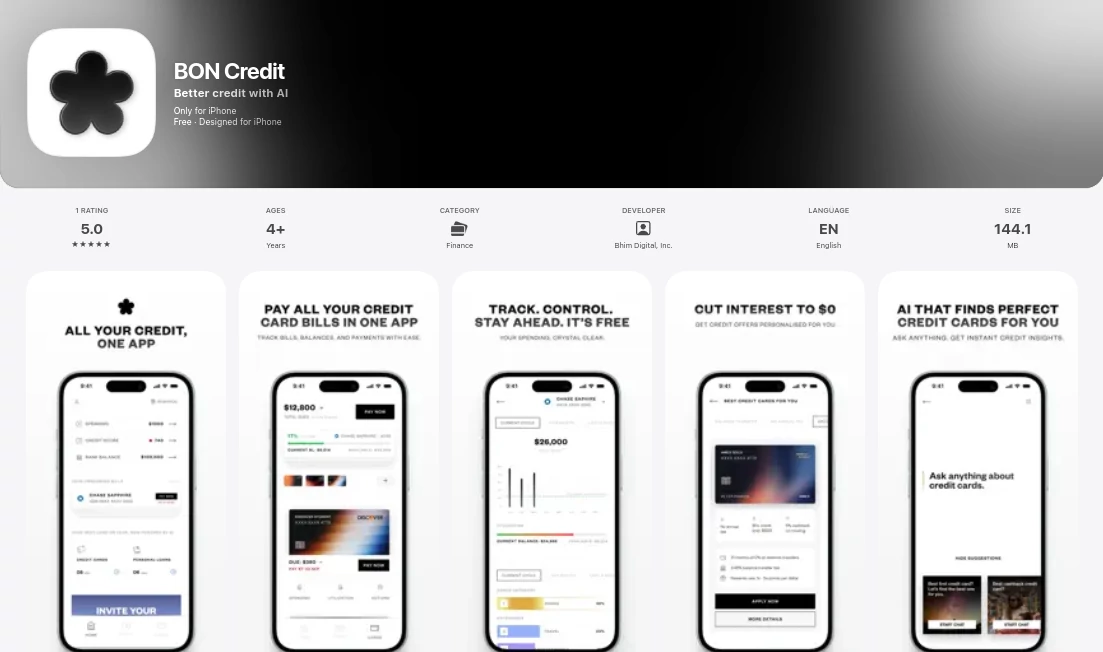

Bon Credit

What is Bon Credit?

Imagine pulling all those scattered credit card bills into one tidy spot, where paying on time feels effortless and actually unlocks real perks—like gift cards from your favorite spots. This app does just that, blending sharp AI insights with a rewarding twist that turns responsible habits into something worth celebrating. I've watched friends go from stressing over due dates to smiling at surprise rewards, and it's the kind of shift that makes managing money feel less like a chore and more like a win.

Introduction

In a time when credit cards pile up and interest sneaks in quietly, this app steps forward with a fresh outlook—rewarding the folks who stay on top of things instead of just tracking the slips. It gathers your cards under one roof, offers an AI buddy to unpack your finances, and sprinkles in perks from big names like Amazon or Spotify for those timely payments. Launched with Gen Z in mind but handy for anyone juggling bills, it's gaining traction for flipping the script on debt dread. One user I know cleared a nagging balance faster than expected, thanks to the clear plans it laid out, proving it's more than tracking—it's guiding you toward breathing room.

Key Features

User Interface

The layout welcomes you with a dashboard that's clean and colorful, showing balances at a glance and nudging you gently toward upcoming dues without overwhelming the screen. Swiping through rewards or chatting with the AI feels natural, like texting a knowledgeable friend, and everything loads quick even on spotty connections. It's that thoughtful design—big buttons for payments, easy toggles for notifications—that keeps you engaged rather than escaping the app.

Accuracy & Performance

Linking cards via secure ties pulls in data spot-on, with the AI crunching numbers to spot savings or flag habits that add up over time. Plans come together reliably, often highlighting ways to shave interest that you'd miss otherwise, and the whole thing runs smooth without crashes or delays. In practice, it's nailed personalized tips that actually moved the needle for users, turning vague worries into concrete steps.

Capabilities

Beyond basic tracking, it crafts debt payoff roadmaps, suggests card matches, and lets you redeem points for tangible treats from hundreds of brands. The built-in AI chats through questions big or small, from "how to boost my score" to daily spending tweaks, all while keeping payments a single tap away. It's this mix—consolidation, guidance, and gratification—that sets it apart for building better habits.

Security & Privacy

Connections lean on trusted bridges like Plaid, with encryption that rivals banks and a firm stance on not hoarding your details longer than needed. You stay in control, data stays yours, and it's built with that reassurance in mind—no surprises, just solid safeguards. For anyone wary of sharing financial info, this approach feels like a trustworthy handshake.

Use Cases

Young pros juggling first cards use it to stay ahead of payments, cashing in rewards that fund small treats without guilt. Families consolidating household bills find the clear overviews a lifesaver, while side-hustlers tap the AI for advice on balancing spends. Even those chipping at older debt appreciate the motivational perks, turning steady progress into something celebratory.

Pros and Cons

Pros:

- Rewards turn discipline into delight, motivating like nothing else.

- AI insights that feel personal and actionable, not generic.

- All-in-one view that simplifies a fragmented financial life.

- Free core that delivers real value from day one.

Cons:

- Best perks shine with consistent on-time pays, so it rewards the already disciplined most.

- Still building out some advanced integrations for niche cards.

Pricing Plans

The heart of it is completely free—no fees for linking cards, tracking, or basic AI chats, making it accessible right out of the gate. Premium touches might layer in for extras down the line, but the foundation stays open, focusing on value that grows with your good habits rather than upfront costs.

How to Use BON Credit

Download and sign up quick, link your cards through the secure prompt—it finds them fast. Browse the dashboard for your snapshot, ask the AI anything from score tips to payoff scenarios, and set up payments with a tap. Watch rewards roll in as you stay current, redeem for what you love, and let the plans guide your next moves. It's straightforward enough that you'll feel in control from the first session.

Comparison with Similar Tools

While many trackers just monitor and remind, this one actively rewards and advises with AI that digs deeper, turning passive viewing into proactive gains. It stands out for the motivational edge—perks over penalties—where others feel more like stern accountants. For anyone seeking encouragement alongside oversight, it's the warmer, wiser choice that aligns with building positive momentum.

Conclusion

This app reimagines credit care as something empowering and even enjoyable, blending smart tech with genuine incentives to foster habits that last. It's a thoughtful companion for navigating finances without the weight, helping turn potential stress into steady progress and small victories. If you're ready to approach bills with confidence and a side of rewards, this one's worth the spot on your home screen.

Frequently Asked Questions (FAQ)

How do rewards work?

On-time payments earn points redeemable for gift cards from top brands—simple as that.

Is my data safe?

Bank-level safeguards and no unnecessary storage keep things secure and private.

What about debt payoff help?

The AI analyzes your setup and suggests tailored plans to minimize interest.

Any hidden fees?

Core features are free, focused on rewarding responsibility rather than charging.

Works with all cards?

Major networks connect seamlessly for a complete picture.

AI Life Assistant , AI Productivity Tools , AI Consulting Assistant .

These classifications represent its core capabilities and areas of application. For related tools, explore the linked categories above.

Bon Credit details

This tool is no longer available on submitaitools.org; find alternatives on Alternative to Bon Credit.

Pricing

- Free

Apps

- iOS Apps

Categories

Bon Credit Alternatives Product