🧠 AI Quiz

Think you really understand Artificial Intelligence?

Test yourself and see how well you know the world of AI.

Answer AI-related questions, compete with other users, and prove that

you’re among the best when it comes to AI knowledge.

Reach the top of our leaderboard.

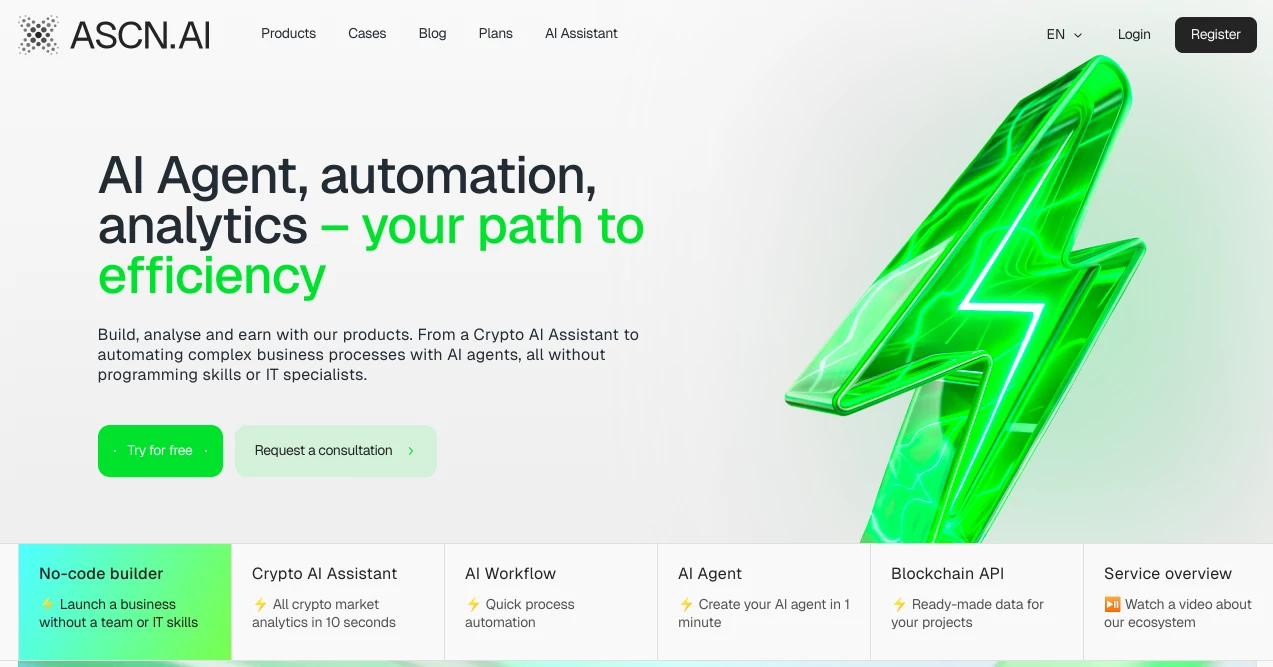

ASCN.AI

Your All-in-One AI for Crypto and Business Wins

What is ASCN.AI?

ASCN pulls together smart tools that make sense of crypto swings and smooth out business bumps, all without needing a tech degree or a big team. It hands over quick breakdowns on market moves and setups for handling leads or chats, letting folks dive into trading or scaling up with less guesswork. Traders and startup heads who've jumped in often point to how it turned scattered hustles into steady gains, like spotting a gem that paid off big in days.

Introduction

ASCN got its start when a handful of market watchers and builders realized chasing crypto trends or juggling daily ops felt like herding cats without the right whistle. They pieced it together to bundle those fixes into one spot, kicking off with basics like fast token checks and easy automations. Word got around fast among indie investors and small outfits tired of piecing together apps, with stories of folks landing their first solid trades or cutting client follow-ups in half. It's grown by listening to those early users, adding bits like ready-made flows that fit right into busy days, turning what used to be a grind into something that clicks without the usual headaches.

Key Features

User Interface

You slide in through a chat window that feels like shooting the breeze with a sharp buddy, typing out what you need and seeing options pop up without hunting menus. Dashboards lay out your setups in simple grids, with drag-and-drop spots for linking steps or tweaking triggers. It's the sort of setup that clicks even if you're more at home with spreadsheets than scripts, keeping things open so you can build on the fly without getting lost in the weeds.

Accuracy & Performance

When it crunches a token's potential, the readouts hold water, drawing from live feeds to flag upsides that pan out, like that one play that bumped returns over sixty percent in under a week. It keeps chugging through peaks without a hiccup, dishing out reports in moments so you can pivot before the window shuts. Users nod to how it sticks close to the facts, rarely chasing ghosts and often highlighting the quiet edges that pay off big.

Capabilities

From scanning chains for fresh plays to stringing together client pings or sales chases, it covers the loop from spotting chances to sealing them. You can spin up a helper that sifts feedback or maps out outreach, all pulled from templates that tweak to your groove. Hooks into outside bits let you layer in data pulls or auto-replies, stretching from solo trades to full-team rhythms without missing a beat.

Security & Privacy

Your setups and scans stay buttoned up, with checks on who touches what and no hanging onto extras after the job's done. It runs on solid rails that keep sensitive pulls—like wallet peeks or deal notes—out of sight, giving you knobs to lock down shares or wipe trails. Folks in the mix appreciate the straightforward guards that let them lean in without that nagging back-of-mind worry.

Use Cases

Traders fire it up for quick dives on up-and-comers, turning hours of charts into ten-second calls that lead to tidy wins. Shop owners automate the after-sale dance, from thank-yous to upsells, dropping costs per lead while bumping replies. New ventures test waters with ready flows for hunting names or sorting queries, hitting strides without the usual startup stumbles. Even teams in marketing lean on it to chase crowds, pulling in hundreds of hits for pocket change and watching conversions climb.

Pros and Cons

Pros:

- Bundles a ton into one dashboard, ditching the app-juggling.

- Speeds up smart moves, from trades to team tasks, without the tech tangle.

- Packs real punch in payouts, like sixty percent lifts in days.

- Easy entry for non-tech types, with chats that guide the way.

Cons:

- Deeper custom bits might need a pro poke for the knottiest knots.

- Base plans cap some heavy runs, nudging ups for full throttle.

- Crypto focus shines brightest, so other lanes feel a tad secondary.

Pricing Plans

It kicks off at twenty-nine bucks a month for the core kit—unlimited chats, basic flows, and starter scans—plenty for solo spins. Bump to pro around fifty for team shares and extra pulls, or go enterprise with custom builds at hourly rates that fit the lift. API taps run pennies per hit, starting at two cents, and white-label setups add a one-time nod fee with no cuts on your take. Trials give a full spin to see if it meshes before the tab hits.

How to Use ASCN

Sign on and chat your goal—say, scout a coin or map a sales loop—and it'll sketch a starter in seconds. Tweak the pieces with simple drags or prompts, test the run on sample data, then flip it live with a nod. Watch the logs for tweaks, link in your tools for seamless pulls, and scale by adding branches as wins roll in. It's that loop of chat, build, launch that keeps things humming without the usual setup sweat.

Comparison with Similar Tools

Where lone scanners just spit numbers, ASCN ties them to actions like auto-trades or lead chases, though those might edge in raw speed for pure peeks. Against full automation packs, it's nimbler for quick crypto hits without the bloat, saving steps for outfits on the move. It lands strong for mixed hustles, blending market smarts with ops ease where others pick one lane and stick.

Conclusion

ASCN clears the clutter of crypto chases and business buzz, handing over a kit that turns hunches into hauls with minimal fuss. It's the sort of setup that lets you chase bigger plays while the small stuff runs itself, proving that smart edges come from blending brains with bits. As markets keep twisting and teams stretch thin, this one's poised to keep folks ahead, one quick win at a time.

Frequently Asked Questions (FAQ)

Do I need coding chops to get going?

Not a whit—just chat your needs, and it builds the bones for you.

How fast does it crunch market bits?

Ten seconds flat for solid reads, leaving you time for the real moves.

Can it hook into my current setup?

Yep, APIs slide right in for seamless data dances.

What's the win rate on those trade tips?

Users hit over sixty percent in spots, but always pair with your gut.

How do I scale for a crew?

Pro plans open shared views and extras, growing as you do.

AI Trading Bot Assistant , AI Investing Assistant , AI Lead Generation , AI Workflow Management .

These classifications represent its core capabilities and areas of application. For related tools, explore the linked categories above.

ASCN.AI details

This tool is no longer available on submitaitools.org; find alternatives on Alternative to ASCN.AI.

Pricing

- Free

Apps

- Web Tools