🧠 AI Quiz

Think you really understand Artificial Intelligence?

Test yourself and see how well you know the world of AI.

Answer AI-related questions, compete with other users, and prove that

you’re among the best when it comes to AI knowledge.

Reach the top of our leaderboard.

Clint

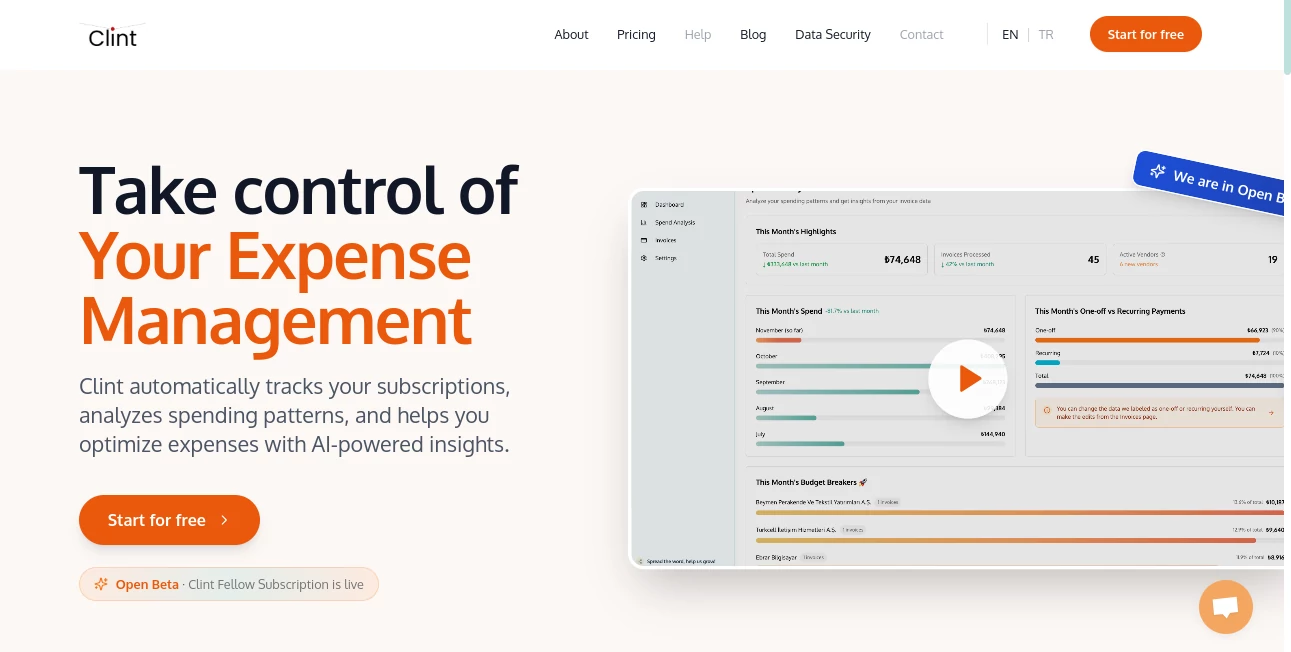

What is Clint?

Ever feel like your wallet's playing hide-and-seek with your hard-earned cash? That's where this gem steps in, quietly spotting those sneaky subscriptions and spending habits that sneak up on you, all with a gentle nudge toward smarter choices. I remember the first time I fired it up—staring at a breakdown of my coffee runs that somehow added up to a small fortune—and suddenly, managing money felt less like a chore and more like chatting with a savvy buddy who's got your back.

Introduction

Picture this: you're knee-deep in emails, bills piling up like unread novels on your nightstand, and that nagging voice in your head whispering about forgotten gym memberships or that streaming service you swore you'd cancel after one binge. Enter Clint, the unassuming hero that's been transforming how folks like us keep tabs on their finances without the usual headache. It's not just another app; it's like having a sharp-eyed accountant who works for free (well, almost) and never judges your impulse buys. Born from the frustration of scattered receipts and foggy recollections, it pulls everything into one spot, using clever tech to reveal patterns you didn't even know existed. Over coffee with a friend last week, she gushed about how it shaved hundreds off her monthly outgoings—real talk from someone who used to wing it with spreadsheets.

Key Features

User Interface

The dashboard hits you like a warm hug—clean lines, no overwhelming charts screaming for attention, just a simple feed of your spends laid out like a friendly timeline. Swipe through categories with ease, tap a transaction for instant context, and watch as suggestions pop up right where you need them. It's that rare tool where even my tech-averse dad could navigate without a single eye-roll, blending smarts with a touch of whimsy in its subtle animations that make checking balances feel almost... enjoyable?

Accuracy & Performance

When it comes to nailing down where your money vanishes, this one's a wizard—scanning emails and bank links with pinpoint precision, rarely missing a beat on recurring charges or one-off splurges. It crunches numbers in the background so smoothly you'd swear it's reading your mind, delivering insights that feel tailor-made rather than cookie-cutter. Last month, it caught a duplicate charge I'd overlooked for weeks; talk about a quiet lifesaver that runs like clockwork without draining your battery or patience.

Capabilities

Beyond basic tracking, it dives deep: spotting trends in your grocery hauls or travel tabs, flagging potential savings on utilities, and even forecasting what next month's bill might look like based on your habits. Link up your accounts once, and it handles the rest—categorizing with eerie smarts, alerting you to price hikes on favorites, and offering bite-sized tips to tweak without upending your life. It's the full package for anyone juggling freelance gigs or family budgets, turning data into doable actions that stick.

Security & Privacy

In a world where data breaches make headlines weekly, this tool stands out by keeping things locked down tight—bank-grade encryption, no selling your info to the highest bidder, just you and your numbers in a secure bubble. It only peeks at what you grant access to, with easy toggles to pause or review anytime. I've slept better knowing my financial snapshot isn't floating around; it's that level of care that turns a utility into something you actually trust with your livelihood.

Use Cases

Freelancers swear by it for sorting client reimbursements from personal dips, keeping tax season from turning into a nightmare. Families use the shared views to align on big buys, like that dream vacation fund that finally stops leaking. Even solo adventurers track impulse souvenirs abroad, coming home with stories instead of regrets. One buddy of mine, a small business owner, credits it with reclaiming hours weekly—time he now spends hiking instead of reconciling ledgers.

Pros and Cons

Pros:

- Uncannily spot-on at uncovering hidden costs you didn't see coming.

- Feels lightweight yet powerful, no bloat to slow you down.

- Actionable advice that actually fits real-life budgets, not pie-in-the-sky ideals.

- Sets up in minutes, rewarding you with wins from day one.

Cons:

- Relies on email or bank syncs, so spotty connections can pause the magic briefly.

- Advanced forecasting shines brighter with a few months of data under its belt.

Pricing Plans

It keeps things fair and flexible: start free to dip your toes, tracking basics without a hitch. Upgrade to premium for around ten bucks a month, unlocking unlimited insights, custom alerts, and those forward-looking forecasts that feel like having a crystal ball. No sneaky fees, just straightforward value that scales with your needs—annual plans even sweeten the deal with a discount, making it easier to commit long-term.

How to Use Clint

Download and sign up with a quick email, then link your banks or forward a few statements—it's that painless. Let it chew on the data overnight, and wake to a personalized rundown: tap a category to drill down, follow a tip to cancel that forgotten app, or set a goal for the next splurge. Over time, chat with it for tailored tweaks, like "show me ways to cut dining out," and watch it deliver without the fluff.

Comparison with Similar Tools

While others bombard you with flashy graphs and generic nudges, this one whispers just the right advice, feeling more like a conversation than a lecture. It's lighter on resources than the heavyweights, yet packs deeper personalization without the steep learning curve. If you're after something that grows with you rather than overwhelming from the start, it edges out the competition by miles—simple, sincere, and seriously effective.

Conclusion

At the end of the day, managing money shouldn't feel like wrestling a spreadsheet octopus— it should empower you to live a little freer, spend a tad wiser, and breathe easier come payday. This tool nails that balance, blending brains with heart to make finances feel approachable and even a bit fun. Give it a spin; you might just find yourself wondering how you ever muddled through without it.

Frequently Asked Questions (FAQ)

Does it work with all banks?

Pretty much—major ones sync seamlessly, and it handles manual uploads for the rest without fuss.

How private is my data really?

Fort Knox levels: encrypted end-to-end, and you control every access point.

Can I share reports with a partner?

Absolutely, with secure invites that let them view without touching your core setup.

What if I'm not tech-savvy?

No worries—it's designed for real people, with prompts that guide you gently every step.

Is there a trial period?

Jump in free forever for essentials, or test premium risk-free for a month.

AI Workflow Management , AI Productivity Tools , AI Task Management , AI Analytics Assistant .

These classifications represent its core capabilities and areas of application. For related tools, explore the linked categories above.

Clint details

This tool is no longer available on submitaitools.org; find alternatives on Alternative to Clint.

Pricing

- Free

Apps

- Web Tools

Categories

Clint Alternatives Product

vivgrid

Sourcetable

eesel AI

Motion