🧠 AI Quiz

Think you really understand Artificial Intelligence?

Test yourself and see how well you know the world of AI.

Answer AI-related questions, compete with other users, and prove that

you’re among the best when it comes to AI knowledge.

Reach the top of our leaderboard.

Daylit

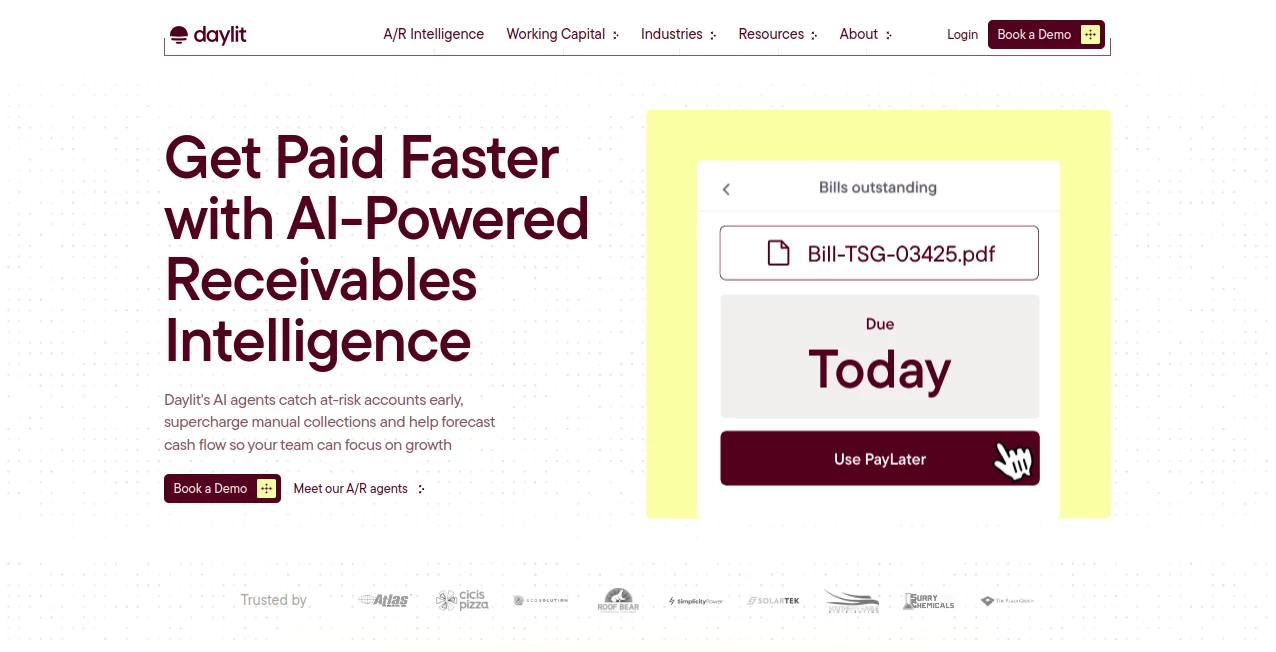

What is Daylit?

Daylit steps in as a reliable partner for businesses wrestling with the ebb and flow of incoming funds, offering a blend of sharp insights and flexible financing to keep operations humming. This platform turns the often-overwhelming task of chasing payments into a smoother ride, empowering teams to spot issues early and unlock capital when it counts. Many who've integrated it into their routines talk about the relief of ditching endless spreadsheets for a system that works around the clock, letting them chase growth instead of dollars.

Introduction

Daylit came together a few years back, sparked by the real-world headaches of finance folks buried under manual tracking and surprise shortfalls. A team of innovators saw the gap—businesses needed more than just loans; they craved a full-circle approach that paired foresight with funding. It started small, testing the waters with early adopters in bustling sectors like healthcare and manufacturing, where cash crunches hit hard. Word spread through quiet wins, like slashing wait times on payments by weeks, and soon it drew in a wave of users sharing stories of how it freed up their days for bigger plays. Today, it's a go-to for companies of all stripes, blending everyday smarts with tailored support to make sure the money side doesn't slow down the momentum.

Key Features

User Interface

The dashboard greets you like an old colleague—straightforward and no-nonsense, with key metrics front and center so you can glance and grasp without digging. Tabs for tracking funds and pulling reports slide in easy, and the mobile view keeps pace, letting you check in from a coffee run or a client meet. Users often mention how the clean lines cut through the noise, turning what could be a cluttered screen into a quick-scan hub that fits right into a packed schedule.

Accuracy & Performance

It pulls in data from your streams and crunches it with a precision that folks trust, often nailing forecasts within a hair's breadth of what actually rolls in. Even during peak seasons, it hums along without a hitch, updating views in real time so decisions land on solid ground. Those who've run the numbers side-by-side swear by the way it spots patterns that slip past the eye, turning potential pitfalls into planned plays.

Capabilities

From scanning your lineup for red flags to spinning up advances on due bills, it covers the ground with tools that automate the chase and open doors to quick cash. You can delay outflows to suppliers or stretch terms for buyers, all backed by options that match your rhythm, like revolving draws for those bigger leaps. It ties it all together with glimpses ahead, helping plot the path without the usual guesswork.

Security & Privacy

Your numbers stay locked down with layers that keep outsiders at bay, handling sensitive streams with the care you'd expect from a trusted advisor. It sticks to the rules on data handling, giving you the reins on what gets shared and when, so peace of mind comes standard. Teams lean on that quiet strength, knowing their inner workings remain just that—theirs.

Use Cases

Growing outfits in fast-paced fields like staffing or dining turn to it for smoothing out seasonal dips, pulling funds to cover payroll without the scramble. Contractors use the early alerts to nudge clients gently, keeping projects on track before delays snowball. Manufacturers forecast swells in orders, drawing lines to stock up without dipping into savings. Even service pros find it handy for blending advances with smart follows, turning one-off gigs into steady streams.

Pros and Cons

Pros:

- Round-the-clock watches that catch slips before they sting.

- No upfront hits to open up, easing the entry.

- Tailored fits that flex with your flow, not against it.

Cons:

- Takes a bit to weave in with older setups.

- Best for those with steady bill streams, spotty ones might stretch.

- Funding perks tie to terms that need watching for the long haul.

Pricing Plans

Getting started runs free, with no strings for setup or sitting idle, making it a low-bar way to test the waters. Costs weave into the funding side, shaped by your pulls and paces, often landing lighter than standalone loans with room to pay ahead. It's built to scale without surprises, rewarding those who use it steady with terms that ease over time.

How to Use Daylit

Kick off with a simple sign-up, then link your ledgers to let the system start scanning. Poke around the board for a feel, set watches on key clients, and when a gap shows, tap into an advance with a quick upload. Follow the nudges on follows or forecasts, tweak as your cycle shifts, and watch the whole thing settle into a rhythm that runs itself.

Comparison with Similar Tools

Where some spots zero in on just the money moves, Daylit layers on the lookout smarts, though those might move quicker for pure cash grabs. Against broader finance hubs, it keeps the focus tight on inflows, skipping the sprawl but perhaps missing wider wallet watches. It shines for teams craving that one-stop ease over scattered suites.

Conclusion

Daylit wraps the worry of waiting funds into a workable wrap, handing businesses the tools to turn tides in their favor. It shifts the spotlight from scrambling to strategizing, proving that a bit of built-in brains can bridge the gaps that hold back the best ideas. As markets keep their unpredictable pulse, this platform stands ready, turning cash flow from a chore into a current that carries you forward.

Frequently Asked Questions (FAQ)

How does the funding side shake out?

It ties to your bills, advancing what you need with repayments that match when clients settle up.

What's the gap between a draw line and a straight loan?

Draws let you pull as needed without the full upfront haul, keeping things nimble.

What spots can the cash hit?

From stocking shelves to snagging deals, anywhere growth calls for quick green.

How much might I tap?

It scales with your stream, often hitting six figures for steady shops.

When can I see the money?

Many grab it same day, turning waits into wins without the wire drama.

Can I wrap it early?

Yes, pay ahead anytime to trim the tab and keep options open.

AI Sales Assistant , AI Accounting Assistant , AI Analytics Assistant , AI CRM Assistant .

These classifications represent its core capabilities and areas of application. For related tools, explore the linked categories above.

Daylit details

This tool is no longer available on submitaitools.org; find alternatives on Alternative to Daylit.

Pricing

- Free

Apps

- Web Tools