🧠 AI Quiz

Think you really understand Artificial Intelligence?

Test yourself and see how well you know the world of AI.

Answer AI-related questions, compete with other users, and prove that

you’re among the best when it comes to AI knowledge.

Reach the top of our leaderboard.

GhostAudit

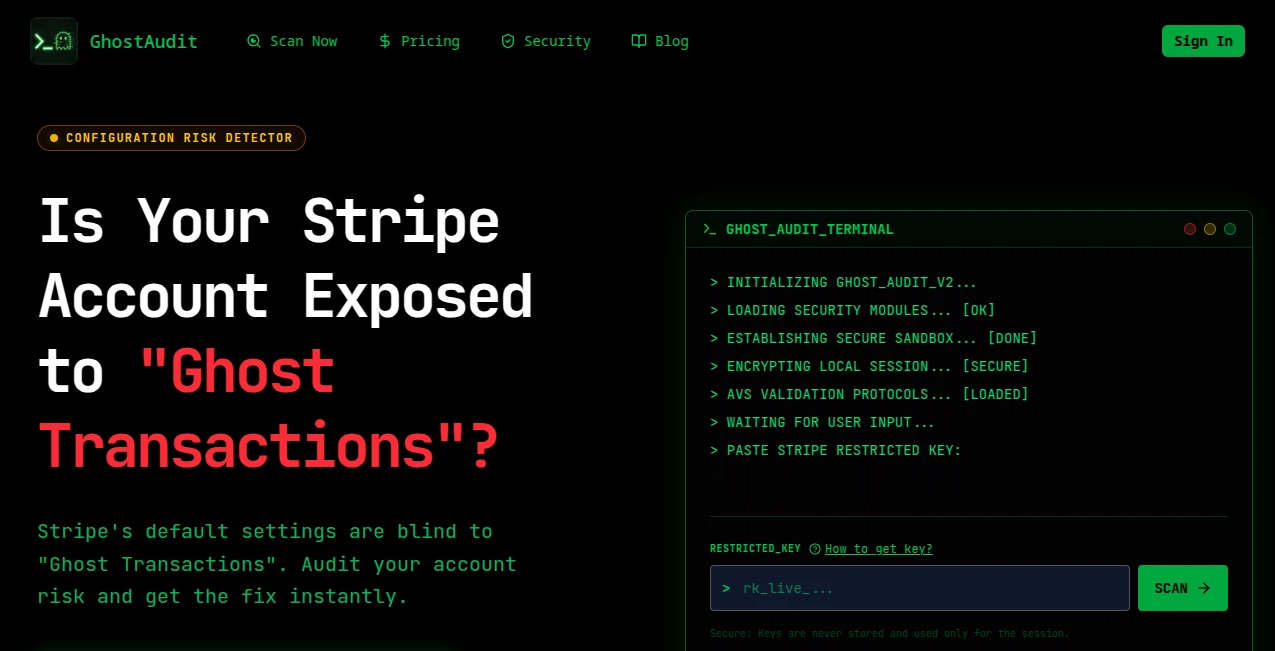

What is GhostAudit?

Running an online business means trusting your payment setup to catch the bad stuff, but what if there's a sneaky gap letting fraud slip through unnoticed? This tool shines a bright light on those hidden risks in Stripe accounts, spotting "ghost transactions" that look legit but bypass key checks. I've heard from founders who thought they were covered, only to find thousands leaking away—until a quick scan here turned things around, plugging holes and restoring peace of mind.

Introduction

Many Stripe users don't realize that billing address validation isn't on by default, leaving doors open for card testers and fraud rings to probe without tripping alarms. This platform steps in with smart detection that scans your recent activity, flags the vulnerabilities, and even hands you ready-to-paste rules to lock it down. It's born from real-world headaches—one dev lost big before building this fix—and now it's saving others from bans, disputes, and needless fees. Simple to start, yet packed with pro-level insights, it's the kind of straightforward safeguard every merchant deserves.

Key Features

User Interface

It keeps things dead simple: plug in a read-only key, hit scan, and watch a clear report unfold with risk scores and patterns highlighted—no jargon overload or confusing dashboards. The terminal-style display feels familiar to devs, while the fix section lays out code snippets plainly for quick copy-paste. It's that rare tool where you get powerful results without wrestling the interface.

Accuracy & Performance

Using a proprietary algorithm tuned for ghost patterns, it digs through your last thousand transactions with sharp precision, catching what Stripe Radar might miss due to config gaps. Reports come back fast, often in minutes, with actionable scores that match real exposure. Founders note how it pinpointed exact leakage rates that aligned perfectly with their dispute spikes, turning vague worries into concrete fixes.

Capabilities

Deep audits reveal ghost rates instantly, AI generates custom Radar rules tailored to your setup (complete with false-positive guards), and ongoing monitoring watches for attacks around the clock. It also flags config risks and suggests one-click tweaks, going beyond detection to prevention that saves on disputes and potential bans.

Security & Privacy

Everything runs on restricted read-only keys you create—no access to funds or sensitive customer details, and keys never get stored on their end. Bank-level encryption and strict data handling mean your info stays put, giving that solid reassurance when dealing with payment vulnerabilities.

Use Cases

SaaS founders run quick checks after hitting revenue milestones, catching validation oversights before disputes pile up. E-com teams integrate the generated rules to shield high-volume checkouts from testing waves. Growing shops use the continuous guard to stay ahead of evolving threats, turning what could be a ban risk into steady, secure growth.

Pros and Cons

Pros:

- Uncovers hidden risks that standard tools overlook, often saving thousands in losses.

- Delivers ready-to-use fixes that implement in minutes.

- Safe and read-only, with no lingering data concerns.

- Free starting scans make it easy to check without commitment.

Cons:

- Focused solely on Stripe, so multi-processor setups need separate checks.

- Full monitoring requires ongoing commitment for always-on protection.

Pricing Plans

Kick off with free audits to gauge your exposure—no strings, just insights. From there, plans scale for deeper scans, custom rule generation, and real-time guarding, fitting everything from solo ops to larger teams without overcomplicating the bill.

How to Use Ghost Audit

Create a restricted read-only key in your Stripe dashboard, paste it in, and let the scan run on recent transactions. Review the report for your ghost rate and patterns, then copy the AI-crafted Radar rule straight into your settings. For ongoing watch, enable the guard features—it's that direct path from discovery to defense.

Comparison with Similar Tools

General fraud monitors often skim the surface or flag too broadly, but this one zeros in on the specific ghost vulnerability with tailored, low-false-positive rules that integrate seamlessly. It's more proactive and precise for Stripe users, turning potential crises into prevented ones where others merely alert.

Conclusion

In the tricky world of online payments, having a sharp eye on subtle risks can make all the difference between smooth sailing and sudden storms. This tool delivers that vigilance with clarity and fixes that stick, empowering merchants to protect their hard-earned revenue. If Stripe powers your checkout, running a quick check here could be the smartest move you make this year.

Frequently Asked Questions (FAQ)

What exactly are ghost transactions?

Payments that authorize without billing address or CVC verification, slipping past Radar and opening doors to testing or fraud.

Is it safe to share my key?

Use restricted read-only access—nothing sensitive touched, keys not stored, full bank-grade protection.

Does it replace Stripe Radar?

No, it enhances it by highlighting misses and providing optimized rules.

How common is this issue?

Affects a majority of accounts due to default settings—many discover leakage only after problems arise.

Can it prevent future attacks?

Yes, with custom rules and continuous monitoring to block threats proactively.

AI Consulting Assistant , AI E-commerce Assistant , AI Analytics Assistant .

These classifications represent its core capabilities and areas of application. For related tools, explore the linked categories above.

GhostAudit details

This tool is no longer available on submitaitools.org; find alternatives on Alternative to GhostAudit.

Pricing

- Free

Apps

- Web Tools