🧠 AI Quiz

Think you really understand Artificial Intelligence?

Test yourself and see how well you know the world of AI.

Answer AI-related questions, compete with other users, and prove that

you’re among the best when it comes to AI knowledge.

Reach the top of our leaderboard.

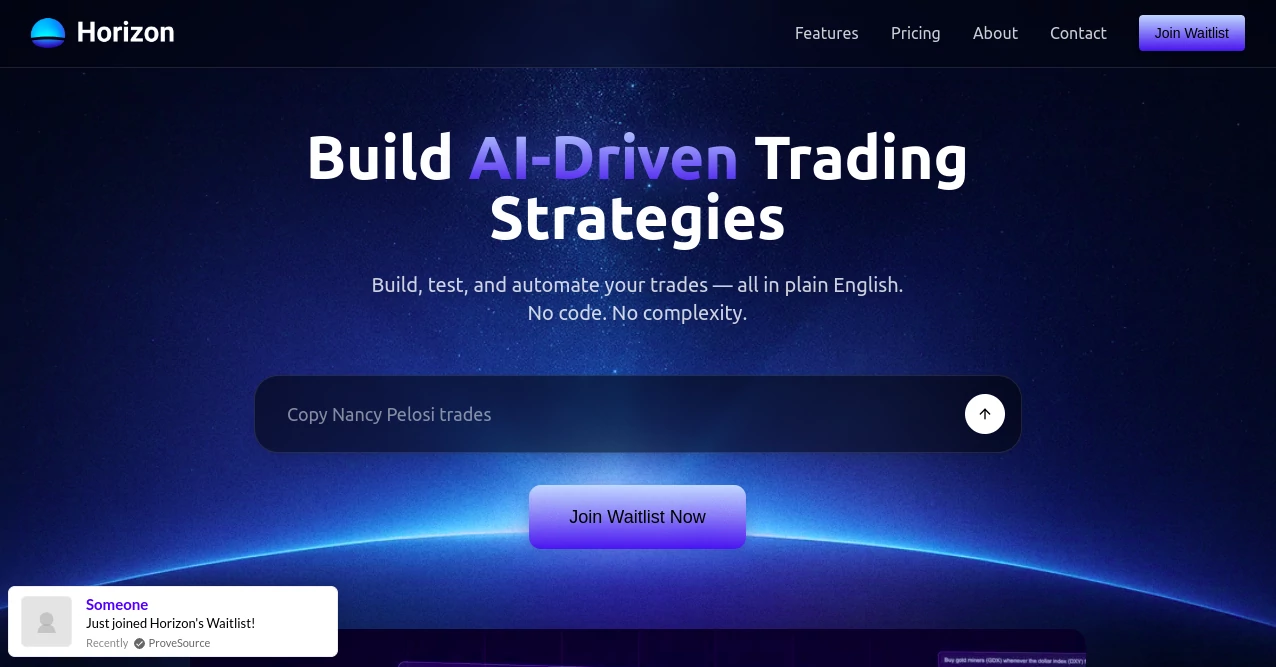

Horizon Trade

Navigate Markets with Precision Insights

What is Horizon Trade?

Horizon Trade serves as a steady hand for investors dipping into the ebb and flow of financial waters, offering tools that spot patterns and flag moments worth noting. This platform pulls together data streams into digestible views, helping users from greenhorns to veterans make calls grounded in trends rather than hunches. It's earned quiet nods from traders who value a setup that hums along without fanfare, turning screen time into smarter plays.

Introduction

Horizon Trade took shape a handful of years ago, sparked by a band of market watchers weary of sifting through noise for signal. They built it as a bridge between raw feeds and real decisions, starting with basics like tickers and charts that anyone could grasp. Word trickled out through forums and chats, drawing in folks who'd hit walls with clunky brokers or pricey add-ons. What keeps it buzzing is the way it grows with you—simple at first glance, but layered enough to uncover edges that pay off over time. Users swap notes on how it caught that one dip or surge, turning what-ifs into actual gains without the usual smoke and mirrors.

Key Features

User Interface

The landing page unfolds like a familiar dashboard, with watchlists stacked on the left and graphs filling the main pane, all in a palette that doesn't strain the eyes during late nights. You drag symbols into slots or tap filters to narrow views, and everything updates with a soft refresh—no jarring reloads or hidden menus that trip you up. Mobile mirrors the flow, shrinking cleanly for thumb swipes, making it feel like an extension of your routine rather than a separate chore.

Accuracy & Performance

It draws from trusted pipes, syncing numbers that match what you'd see on big boards, often within ticks of live action. Alerts hit your inbox or buzz without false alarms, tuned to cut through volatility with signals that hold water in backtests. Even under load, charts render swift, letting you zoom through histories or sims without the drag that kills momentum on lesser setups.

Capabilities

From scanning sectors for sleepers to modeling what-ifs with historical overlays, it covers the spread—stocks, bonds, even crypto dips if you poke around. Build custom scans that flag breakouts or pair trades, or lean on pre-baked plays that nod to classics like momentum chases. Link it to your broker for one-click jumps, or export reports for deeper dives in spreadsheets, keeping the whole kit versatile for day hops or long hauls.

Security & Privacy

Logins lock with multi-steps and biometrics where it fits, keeping your positions under wraps from outsiders. Data flows encrypted end-to-end, and you set the reins on what shares with linked accounts—no auto-pulls without a nod. It sticks to the rules on holding info, wiping temps after sessions and letting you audit trails, so you trade with eyes wide open on the backend guardrails.

Use Cases

Day traders eye it for quick sector sweeps, nabbing openings before the herd piles in. Retirees use the sim tools to test dividend tweaks without real stakes, easing into shifts. Analysts at firms batch reports for client briefs, pulling tailored views that save hours of manual crunches. Even hobbyists track fun bets like meme stocks, turning pastime scans into occasional wins.

Pros and Cons

Pros:

- Blends depth with ease, no PhD needed to spot value.

- Custom alerts cut the constant watch, freeing headspace.

- Cross-device sync keeps you looped wherever you roam.

Cons:

- Advanced sims might overwhelm pure beginners at first.

- Relies on steady nets for peak snap, spotty spots lag.

- No built-in news ticker, so pair with feeds for full pulse.

Pricing Plans

Free tier gives the basics—charts and scans for a few symbols—to whet the appetite. Standard bumps to twenty monthly for unlimited lists and alerts, while pro at fifty adds sim runs and API hooks. Teams scale with add-ons, and yearly locks in savings of a quarter, with a no-sweat month to trial the full spread before settling.

How to Use Horizon Trade

Sign up with basics, then seed your watchlist with tickers from the search bar. Tweak scans to match your style—growth chasers or value hunts—and set pings for crosses. Run a backtest on a hunch to gauge legs, link your trade spot for seamless jumps, and review logs weekly to refine the edge. It's a loop that sharpens with each pass, building habits that stick.

Comparison with Similar Tools

Against flashy apps that dazzle with bells, Horizon Trade keeps it grounded, trading hype for reliable rips, though those might suit show-offs better. Versus enterprise heavies, it lightens the load for independents, skipping the bloat but maybe missing deep integrations. It stands out for balanced bites, where speed meets smarts without skimping on the substance.

Conclusion

Horizon Trade charts a course through market mazes, arming users with views that clarify rather than confuse. It turns the art of investing into a craft honed by data, not dice rolls, yielding steadier strides in uncertain seas. As trades keep twisting, this platform holds the line, a compass for those chasing horizons with clear eyes and steady hands.

Frequently Asked Questions (FAQ)

What markets does it cover?

Equities, fixed income, and select alts like digital coins.

Can I trade directly from here?

Links to your broker, but execution stays on their turf.

How fresh is the data?

Real-time for majors, delayed a tick for off-beats.

Is there mobile support?

Full app and web responsive for on-the-move checks.

What if I need help?

Guides in-app, plus chat for sticky spots.

AI Research Tool , AI Trading Bot Assistant , AI Investing Assistant , AI Analytics Assistant .

These classifications represent its core capabilities and areas of application. For related tools, explore the linked categories above.

Horizon Trade details

This tool is no longer available on submitaitools.org; find alternatives on Alternative to Horizon Trade.

Pricing

- Free

Apps

- Web Tools