🧠 AI Quiz

Think you really understand Artificial Intelligence?

Test yourself and see how well you know the world of AI.

Answer AI-related questions, compete with other users, and prove that

you’re among the best when it comes to AI knowledge.

Reach the top of our leaderboard.

IntoTheBlock

is an AI-powered financial services platform providing real-time crypto market intelligence targeting institutional investors in DeFi. It offers insights, risk management tools, and advanced analytics for cryptocurrencies like Bitcoin and Ethereum.

What is IntoTheBlock?

Exploring IntoTheBlock: A Deep Dive into Crypto Analytics and Market Intelligence

The world of cryptocurrency is fast-paced, complex, and ever-evolving. For investors, traders, and developers navigating this dynamic landscape, access to reliable data and actionable insights is crucial. This is where IntoTheBlock comes into play—a cutting-edge platform that has established itself as a leader in providing on-chain analytics, market intelligence, and decentralized finance (DeFi) tools. Whether you’re a seasoned crypto enthusiast or a newcomer looking to make informed decisions, IntoTheBlock offers a suite of resources designed to empower users with institutional-grade financial intelligence. In this article, we’ll explore what IntoTheBlock is, its key features, and why it’s become a go-to platform for anyone serious about understanding the crypto market as of March 30, 2025.

What is IntoTheBlock?

IntoTheBlock is a data science company founded in 2018, headquartered in Miami, Florida, with a mission to unlock the mysteries of the cryptocurrency market through advanced technology and artificial intelligence (AI). The platform specializes in delivering real-time crypto market intelligence by analyzing on-chain data—information directly sourced from blockchain transactions. Unlike traditional financial markets, where data might come from centralized exchanges or regulatory filings, the decentralized nature of cryptocurrencies allows platforms like IntoTheBlock to tap into blockchain ledgers, providing a transparent and unfiltered view of market activity.

The company’s vision is clear: they see crypto assets as a fundamental part of the future financial ecosystem. As this space grows, IntoTheBlock aims to serve as a trusted authority for investors, traders, and institutions seeking to understand digital assets. By combining AI-driven insights with comprehensive data analysis, IntoTheBlock bridges the gap between raw blockchain data and actionable knowledge, making it accessible to both sophisticated traders and everyday users.

Core Features of IntoTheBlock

IntoTheBlock stands out for its holistic approach to crypto analytics, offering tools and insights across several key areas. Here’s a breakdown of what users can expect when visiting https://www.intotheblock.com:

1. On-Chain Analytics

2. DeFi Analytics and Risk Radar

3. Market Intelligence Suite

4. AI-Powered Insights

5. Educational Resources

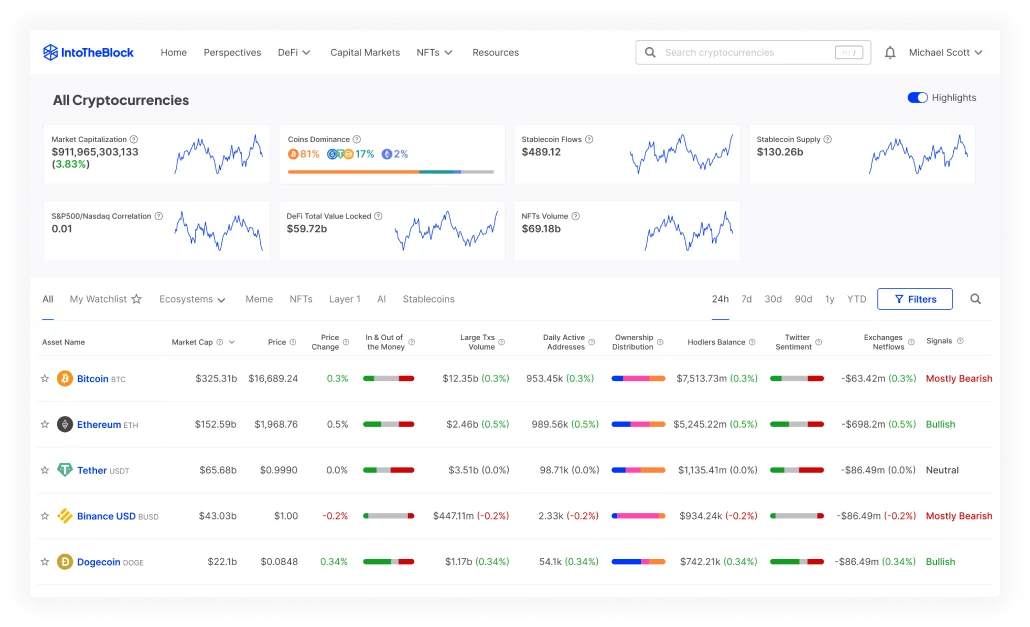

At the heart of IntoTheBlock’s offerings is its on-chain analytics suite. This feature allows users to explore data directly from blockchain networks, such as Bitcoin, Ethereum, Litecoin, and over 1,000 other assets. On-chain metrics include financial indicators (e.g., transaction volume, market cap), network health (e.g., active addresses, hash rate), ownership patterns (e.g., concentration of holdings by large wallets), and exchange flows (e.g., inflows and outflows from centralized platforms). These metrics provide a granular view of how a cryptocurrency is performing and how its community is behaving, offering insights that go beyond simple price charts.

Decentralized Finance (DeFi) has become a cornerstone of the crypto ecosystem, and IntoTheBlock has positioned itself as a leader in this space. The platform offers advanced analytics for DeFi protocols, including total value locked (TVL), protocol-specific risk indicators, and yield-generating opportunities. One standout tool is the DeFi Risk Radar, which provides real-time risk signals calculated on a block-by-block basis. This is particularly valuable for institutional investors and risk managers overseeing billions of dollars in capital, as it helps them navigate the volatile and often unpredictable world of DeFi.

Beyond on-chain data, IntoTheBlock’s Market Intelligence Suite incorporates off-chain factors such as social sentiment, trading volume from spot and derivatives markets, and unique “Perspectives” dashboards. These dashboards focus on specific trends or events—like the Bitcoin halving or the rise of real-world assets (RWAs) in DeFi—offering users a deeper understanding of market dynamics. With support for over 1,000 assets, this suite is constantly expanding to cover new chains and tokens, ensuring users stay ahead of the curve.

What sets IntoTheBlock apart from many competitors is its use of artificial intelligence. The platform employs machine learning algorithms to analyze hundreds of data points, generating insights that are both sophisticated and easy to understand. For example, the MVRV (Market Value to Realized Value) ratio helps users identify whether an asset is overvalued or undervalued based on what investors paid for it, while indicators like long-term holder behavior reveal market cycle patterns. These AI-driven tools make complex data accessible to everyone, not just expert traders.

IntoTheBlock isn’t just about data—it’s also about knowledge. Through its Resources section (resources.intotheblock.com), the platform offers guides, webinars, and articles to help users understand how to interpret on-chain metrics and apply them to their strategies. This educational focus makes it an excellent starting point for newcomers while still providing value to seasoned professionals.

Why IntoTheBlock Matters in 2025

As of March 30, 2025, the cryptocurrency market continues to mature, with increasing adoption by institutions, governments exploring digital asset reserves, and DeFi protocols reshaping traditional finance. IntoTheBlock’s relevance has grown alongside these trends. For instance, its coverage of Bitcoin halving cycles—events that historically influence BTC’s price—offers users predictive insights based on historical data. Similarly, its analysis of meme coins, which saw their market cap nearly triple in 2024, reflects the platform’s ability to adapt to emerging trends.

The platform’s institutional-grade tools are particularly significant as more hedge funds, venture capital firms, and traditional financial players enter the crypto space. Customers like Binance, TradingView, and Business Insider rely on IntoTheBlock’s data, underscoring its credibility. Meanwhile, its focus on DeFi risk management addresses a critical need in a sector known for high rewards and equally high risks, making it indispensable for anyone managing large portfolios.

How to Get Started with IntoTheBlock

Visiting https://www.intotheblock.com is the first step to exploring this powerful platform. IntoTheBlock offers a 7-day free trial, allowing users to test its features before committing to a subscription. Pricing varies based on the level of access—individuals might opt for basic analytics, while institutions can unlock advanced tools like the DeFi Risk Radar. The website is user-friendly, with a clean interface that makes it easy to navigate between assets, dashboards, and resources.

For those active on social media, IntoTheBlock maintains a strong presence on platforms like LinkedIn, X, and YouTube, where they share updates, webinars, and market insights. Following them on these channels can provide a steady stream of valuable information, complementing the data available on the main site.

IntoTheBlock vs. Competitors

IntoTheBlock isn’t the only player in the crypto analytics space—competitors like Glassnode, CryptoQuant, and Nansen offer similar services. However, IntoTheBlock distinguishes itself with its AI integration, broad asset coverage (over 1,000 tokens), and focus on DeFi risk management. While Glassnode excels in deep blockchain data and Nansen focuses on wallet tracking, IntoTheBlock’s all-in-one approach—combining on-chain, off-chain, and educational resources—makes it a versatile choice for a wide audience.

Final Thoughts

IntoTheBlock is more than just a data platform—it’s a gateway to understanding the cryptocurrency market in a way that’s both comprehensive and accessible. As of March 30, 2025, its blend of on-chain analytics, DeFi tools, and AI-powered insights positions it as an essential resource for anyone looking to thrive in the crypto space. Whether you’re tracking Bitcoin’s next move, evaluating a DeFi protocol’s risk, or simply trying to make sense of market trends, IntoTheBlock delivers the tools and knowledge you need to succeed. Visit the site today, explore its offerings, and see how it can elevate your crypto journey.

Recommended Pages for This Product

MARKET INTELLIGENCE

Experience the power of advanced analytics

DEFI RISK RADAR

Stay one step ahead. Protect yourself from risk in DeFi

DEFI SMART YIELDS

Grow your assets with confidence and security

IntoTheBlock: video demonstration

AI Papers , AI Analytics Assistant , Web3 , AI Newsletter , AI Research Tool , AI Trading Bot Assistant , AI Investing Assistant , AI NFTs , AI Blockchain .

These classifications represent its core capabilities and areas of application. For related tools, explore the linked categories above.

IntoTheBlock details

Pricing

- Free

Apps

- Web Tools