🧠 AI Quiz

Think you really understand Artificial Intelligence?

Test yourself and see how well you know the world of AI.

Answer AI-related questions, compete with other users, and prove that

you’re among the best when it comes to AI knowledge.

Reach the top of our leaderboard.

MarketAlerts AI

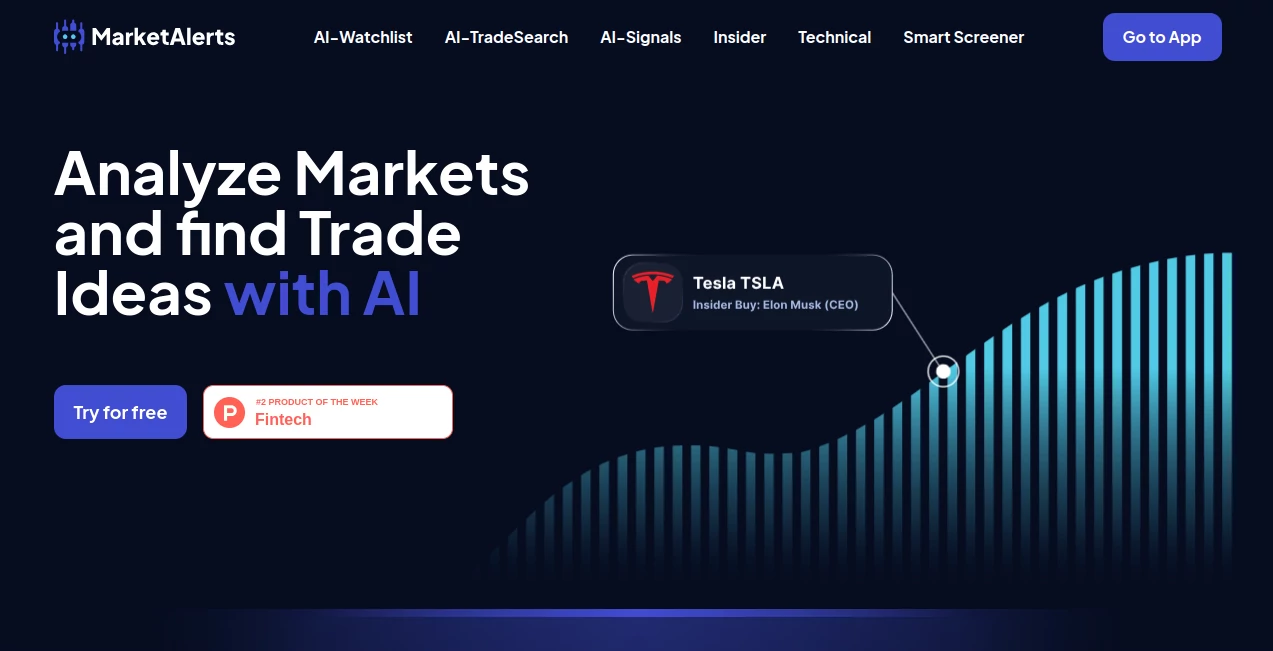

What is MarketAlerts AI?

Keeping tabs on a handful of stocks without missing key moments can feel like a full-time job, but this platform turns it into something almost effortless. It watches your chosen tickers around the clock, pinging you only when something truly noteworthy pops up—like a sudden breakout pattern or an insider scoop that could shift the tide. I've added a few familiar names to my list just to test, and the alerts landed timely and spot-on, cutting through the daily noise to highlight what actually matters.

Introduction

In busy markets spanning dozens of countries, spotting the signals that move prices shouldn't require endless scrolling or guesswork. This service steps in with smart watchlists that track everything from earnings summaries to technical shifts and corporate shake-ups, delivering concise notifications that feel tailored rather than overwhelming. A friend in trading mentioned how it flagged a guidance upgrade on a quiet stock he'd overlooked, leading to a timely move he still thanks it for. Free to start building your lists, it's designed for anyone from casual investors to active traders who want an extra set of eyes on the action without the constant chatter.

Key Features

User Interface

The dashboard lays out your watchlist front and center, with tickers grouped neatly and recent highlights flagged in clear cards that show the why behind each alert. Adding new ones is as simple as typing a symbol, and filters let you zero in on types like technicals or insiders without digging through menus. It's straightforward enough that you spend more time thinking about the info than navigating to it.

Accuracy & Performance

Alerts trigger on real events—think revenue beats, pattern breakouts, or lawsuit filings—with summaries that get to the point fast and accurately. It pulls from reliable streams across global exchanges, keeping delays minimal so you're in the loop when it counts. In practice, the hits feel dependable, rarely crying wolf on minor blips but shining on those potential game-changers.

Capabilities

Core strength lies in monitoring for earnings insights, chart patterns, product launches, guidance changes, analyst shifts, insider moves, M&A buzz, auditor notes, and legal flags—covering over 20 markets worth of assets. Pair that with a smart screener for custom hunts and AI-driven idea searches, and you've got a robust kit for uncovering opportunities without manual marathons.

Security & Privacy

Your watchlists stay personal, with standard protections handling logins and data flows quietly in the background. It's the kind of no-fuss approach that lets you focus on markets rather than worries.

Use Cases

Long-term holders get nudged on fundamental shifts like margin improvements or rating upgrades that signal deeper value. Day traders catch technical breakouts or volume spikes for quicker plays. Portfolio managers scan for risks like lawsuits or auditor flags across holdings. Even curious newcomers build lists around themes, learning as alerts highlight real-world impacts.

Pros and Cons

Pros:

- Pinpoints meaningful events amid the flood, saving serious screen time.

- Broad coverage across international markets for diverse portfolios.

- Clean, actionable summaries that inform without overload.

- Free entry to core watchlists lowers the barrier nicely.

Cons:

- Depth shines on supported events—niche metrics might need extra sources.

- Notifications lean text-based, though effective in their simplicity.

Pricing Plans

Jump in free to create and monitor watchlists, experiencing the alerts firsthand without commitment. As your tracking grows, upgrades likely unlock fuller access or advanced screens, keeping things scalable for lighter or heavier use.

How to Use MarketAlerts

Start by searching and adding tickers to your watchlist—mix stocks from various exchanges as needed. Browse recent alerts to get a feel, then sit back as new ones roll in via your preferred channel. Dive into details on clicks, or use the screener for broader hunts when inspiration strikes.

Comparison with Similar Tools

Basic news feeders drown in volume, while premium scanners often cost a bundle—this one strikes a balance with focused, AI-curated highlights across global plays at an approachable entry. It's less about raw data dumps and more about distilled insights that fit real decisions.

Conclusion

This platform brings a calm clarity to market watching, surfacing the updates that merit attention while letting the rest fade into the background. It's a thoughtful companion for anyone navigating investments, blending broad reach with precise pings that inform without exhausting. Add a few favorites and see how it sharpens your view—often, that's all it takes to appreciate the difference.

Frequently Asked Questions (FAQ)

What events trigger alerts?

Earnings summaries, technical patterns, product news, guidance shifts, ratings, insiders, M&A, auditors, and lawsuits, among others.

How many markets are covered?

Over 20, spanning major exchanges worldwide for wide asset tracking.

Is it free to try?

Yes—build watchlists and receive alerts at no initial cost.

Can I customize notifications?

Focus on your tickers, with built-in filters for event types.

Works for non-stock assets?

Primarily stocks, but broad event coverage suits various equities.

AI Research Tool , AI Trading Bot Assistant , AI Investing Assistant , AI Analytics Assistant .

These classifications represent its core capabilities and areas of application. For related tools, explore the linked categories above.

MarketAlerts AI details

This tool is no longer available on submitaitools.org; find alternatives on Alternative to MarketAlerts AI.

Pricing

- Free

Apps

- Web Tools

Categories

MarketAlerts AI Alternatives Product