🧠 AI Quiz

Think you really understand Artificial Intelligence?

Test yourself and see how well you know the world of AI.

Answer AI-related questions, compete with other users, and prove that

you’re among the best when it comes to AI knowledge.

Reach the top of our leaderboard.

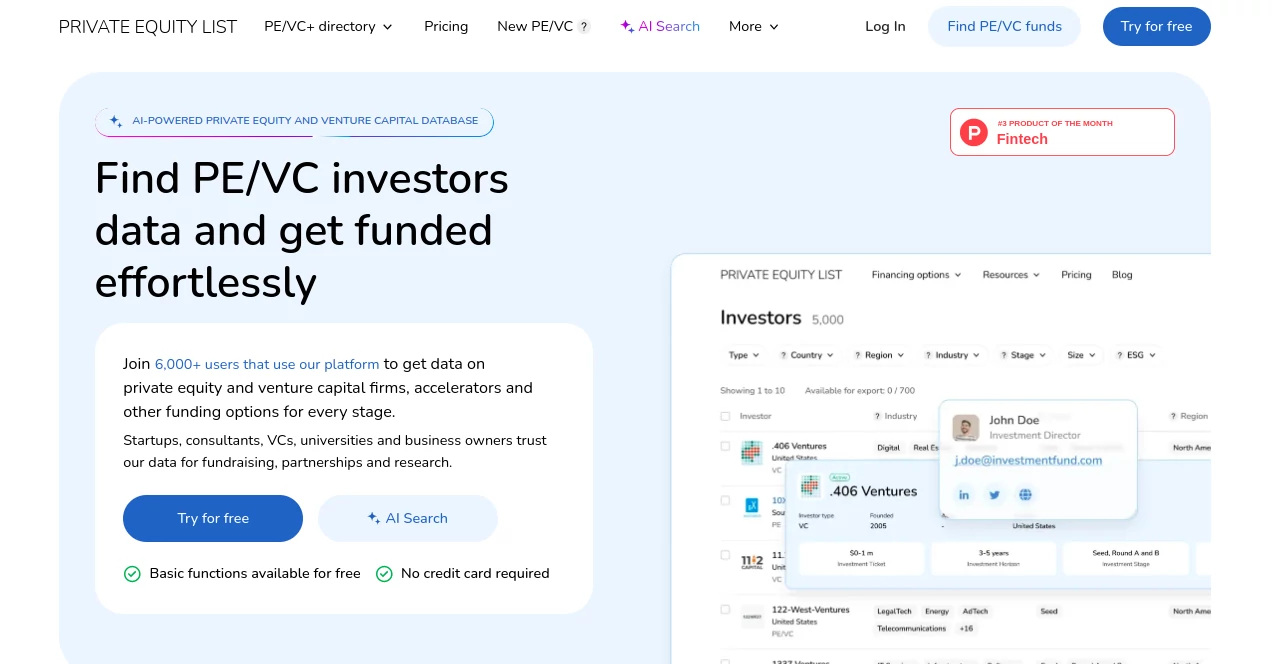

PRIVATE EQUITY LIST

Global Investor Database for Smart Fundraising

What is PRIVATE EQUITY LIST?

Private Equity List serves as a treasure trove for those hunting down funding partners, pulling together details on thousands of private equity and venture capital outfits from every corner of the globe. It's the kind of spot where a startup founder might stumble on that one connection that flips a pitch into a handshake, or a consultant uncovers leads that close deals faster. With a nod to overlooked spots like the Middle East or Southeast Asia, it levels the playing field for dreamers beyond the usual hubs, turning what could be a wild goose chase into a targeted trek.

Introduction

Private Equity List kicked off with a simple itch—too many folks chasing cash were stuck sifting through scattered lists or pricey reports that barely scratched the surface. A team of finance buffs decided to knit together a no-nonsense roundup, starting small but swelling to over six thousand funds and twenty-five thousand contacts as word spread. Founders and advisors started buzzing about it in quiet chats over coffee, sharing how it shaved weeks off their legwork. What keeps it humming is that steady drip of fresh entries, month after month, making sure you're not chasing ghosts but real opportunities that match the moment.

Key Features

User Interface

You step in and it's like flipping open a well-thumbed directory—clean search bars up top, filters tucked neatly to the side for tweaking by spot or stage. A few clicks and you're staring at a grid of matches, each card spilling just enough to spark interest without overwhelming the eyes. It's that rare setup where even a first-timer feels like they've been using it for years, with export buttons right there for grabbing what catches your fancy.

Accuracy & Performance

The pulls come from solid sources, landing you lists that hold water under a quick double-check, though a glance over for the odd slip is wise. It zips through queries without a pause, even when you're narrowing down to niche corners like Latin America grants, keeping your momentum from fizzling out mid-hunt. Users nod to how it surfaces gems that pay off quick, often leading to chats that wouldn't have crossed paths otherwise.

Capabilities

Beyond the basics, it maps out everything from early bets to late-stage lifts, tossing in accelerators, grants, and even crowdfunding paths for those off-the-beaten-track needs. You can sift for funds backing underrepresented voices or zoom into fresh launches from the last half-year, all while eyeing team rosters for that warm intro. It's built to feed not just searches but whole strategies, from scouting partners to plotting sales.

Security & Privacy

Your hunts stay under your hat, with no need to spill sensitive bits upfront and standard locks on the basics to keep snoops at bay. It doesn't hold onto more than it needs, letting you poke around without leaving a trail that lingers. That quiet assurance means you can dig deep into prospects without the nagging worry of what sticks around after.

Use Cases

A bootstrapped outfit in Dubai might filter for regional VCs eyeing tech plays, landing intros that bridge local gaps. Consultants pitch clients on M&A trails by pulling buyer profiles that fit like a glove. University researchers harvest trends for papers, while business sellers scout PE groups hungry for their niche. Even journalists clip structured nuggets for stories that need that finance bite.

Pros and Cons

Pros:

- Covers far-flung spots others skip, opening doors to global plays.

- Filters cut the chase, surfacing fits in a handful of taps.

- Fresh feeds keep you ahead of the curve on new funds.

- Free entry point lets you test without dipping into pockets.

Cons:

- Deeper contacts hide behind the upgrade wall.

- AI bits might trip on edges, calling for a quick fact-check.

- No frills on the visuals, which suits some but not show-offs.

Pricing Plans

You can wander the basics for free, no card needed, grabbing overviews and starter filters to get a feel. For the full scoop on names and numbers, the pro tier steps in, though the exact tab varies—think mid-range monthly for unlimited digs and exports. It's that simple split: dip your toe without cost, then scale up when you're hooked on the hunt.

How to Use Private Equity List

Pop over and sign in quick to unlock the search, then layer on your must-haves like stage or sector in the filters. Scan the hits for sparks, click through for deeper dives on funds or teams, and snag exports for your notes. Keep an eye on the new arrivals feed for timely tips, and when you're ready for direct lines, flip to pro for the full reach.

Comparison with Similar Tools

Where big-league lists charge a fortune for US-heavy rosters, this one spreads wide and keeps the door cracked open. Others might stick to flashy charts but skimp on the edges of the map, while here the focus stays on practical pulls that work for the underdogs too. It carves out a niche for those who want breadth without the bloat or the bill shock.

Conclusion

Private Equity List turns the foggy world of funding hunts into a clearer path, handing over tools that connect dots across borders and backstories. It's a reminder that the right match might be hiding in the spots everyone else overlooks, waiting for a nudge to light up. For anyone with a venture brewing or a deal in mind, this spot proves that a little structure goes a long way toward making those big leaps land soft.

Frequently Asked Questions (FAQ)

What's the reach on the fund count?

Over six thousand strong, with room to grow as fresh ones roll in.

Do I pay to peek at contacts?

Basics are open, but the nitty-gritty names need the pro pass.

How does it stack against pricey rivals?

It goes global without the gouge, hitting spots they barely touch.

Who winds up using it most?

From fresh founders to deal makers, anyone chasing investor intros.

Any focus on niche backers?

Yeah, it spotlights groups lifting underrepresented voices too.

AI Research Tool , AI Business Ideas Generator , AI Consulting Assistant , AI Sales Assistant .

These classifications represent its core capabilities and areas of application. For related tools, explore the linked categories above.

PRIVATE EQUITY LIST details

This tool is no longer available on submitaitools.org; find alternatives on Alternative to PRIVATE EQUITY LIST.

Pricing

- Free

Apps

- Web Tools