🧠 AI Quiz

Think you really understand Artificial Intelligence?

Test yourself and see how well you know the world of AI.

Answer AI-related questions, compete with other users, and prove that

you’re among the best when it comes to AI knowledge.

Reach the top of our leaderboard.

Vossa App

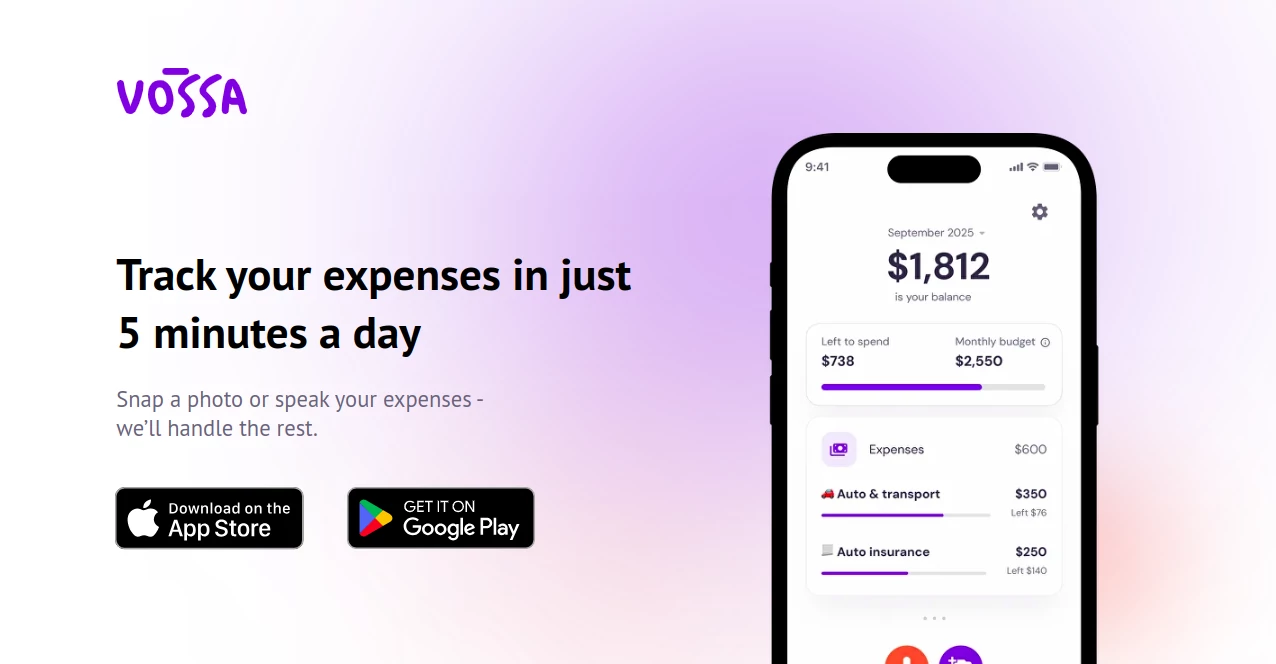

Effortless Expense Tracking in 5 Minutes a Day

What is Vossa App?

Vossa slips into your daily routine like a quiet reminder on your phone, capturing every coffee run or grocery haul without the usual hassle. It's the kind of app that makes sense of your spending habits before they pile up, using a bit of smarts to sort things out so you can focus on the fun parts of life. Folks who've tried the old ways—endless spreadsheets or glitchy bank links—often end up ditching them for something this straightforward, sharing how it finally got them back in control without feeling like a chore.

Introduction

Vossa came about when a couple of everyday spenders got fed up with apps that promised the moon but delivered headaches, like syncing woes or clunky interfaces that ate more time than they saved. They rolled it out as a fresh take, aiming to nail the basics: quick entry, smart sorting, and clear overviews that actually help you tweak habits. Word spread through chats in coffee shops and family group texts, with users nodding along to stories of spotting sneaky subscriptions or nailing holiday budgets. It's grown into a pocket companion for busy parents, freelancers, and anyone who's ever wondered where the paycheck vanished, proving that good tools don't need bells and whistles to make a real difference.

Key Features

User Interface

The screen opens to a simple dashboard that feels like flipping open a notebook— a big plus button for new entries, a list of recent spends scrolling easy, and a quick stats bar up top showing where you're at. No buried menus or confusing icons; just tap to add, swipe to edit, and peek at breakdowns with a gentle nudge. It's built for thumbs on the go, with voice cues that listen without fumbling, making it a breeze even if you're juggling bags at checkout.

Accuracy & Performance

It grabs details from a mumbled voice note or a blurry receipt snap and slots them right, rarely mixing up that lunch tab with rent. Things load zippy, even after a month's worth of entries, and the sorts hold steady without second-guessing. Users mention how it catches the little things—like splitting a dinner bill—that trip up other setups, keeping your totals spot-on so decisions feel grounded, not guessed.

Capabilities

Beyond jotting down buys, it groups them into everyday buckets like eats or rides, flagging when you're nearing a self-set cap. Snap a bill and it pulls the numbers, or chat it in hands-free for those drive-thru moments. You can tweak categories on the fly or share glimpses with a partner for joint tracking, turning solo tallies into team efforts without extra apps.

Security & Privacy

Your logs stay tucked away on your device first, only syncing if you say so, with standard locks to keep nosy eyes out. It skips the deep dives into bank accounts, so no sharing sensitive strings, and wipes temps after use to lighten the load. That means you rest easy knowing your coffee fund secrets don't wander off, all while meeting the basics for safe keeping.

Use Cases

A freelancer logs client lunches on the fly, watching how they stack against project payouts to adjust rates mid-month. Families split grocery runs, with quick shares that settle who owes what without awkward asks. Travelers track trip tabs, spotting deals or overruns before the card statement shocks. Even students budget book buys and takeout, building habits that stretch scholarships further.

Pros and Cons

Pros:

- Slides into routines with voice and snap options that feel natural.

- Auto-sorts keep things tidy without manual nudges every time.

- Clear snapshots help spot patterns fast, no digging required.

- Starts free, easing you in before any commitment.

Cons:

- Free cap at thirty entries might cramp heavy spenders early.

- No deep bank ties means extra steps for auto-pulls.

- Custom tweaks limited until you bump up plans.

Pricing Plans

The starter tier's a no-risk dip, handling thirty logs a month with voice chats and basic sorts, all without a card upfront. For the full ride, premium unlocks endless entries, receipt reads, and your own buckets for around a few bucks weekly or less monthly. It's flexible, with monthly dips or yearly saves, so you scale as your spending stories grow.

How to Use Vossa

Grab it from your phone's shop, set up with a quick email, and start by chatting in that morning latte or snapping the tag. Peek at the list to fix any slips, set a watch on fun funds, and let the overview nudge you toward tweaks. Share a view with a buddy for group tabs, or export for tax time—it's that loop that keeps things light and on track.

Comparison with Similar Tools

Where bank apps drag with sync snags and spreadsheets demand daily dances, Vossa keeps it light with spot entries that fit real life. Others might overload with charts, but this one sticks to essentials, edging out for folks who want smarts without the setup. It's the middle ground for quick trackers tired of the extremes.

Conclusion

Vossa wraps up the worry of wandering wallets into a tidy daily ritual, turning numbers into nudges that build better habits. It proves you don't need a finance degree to feel in charge, just a tool that listens and lays it out plain. As life keeps throwing curveballs at your budget, this app stands ready to catch them, one simple entry at a time.

Frequently Asked Questions (FAQ)

Can it handle cash buys?

Yep, voice it in or snap the receipt—no bank link needed for those.

What if I go over the free limit?

It nudges you to upgrade, but you can always clear old ones to keep going.

Does it work offline?

Entries save local first, syncing when you're back in range.

How do shares work for couples?

Send a link for view-only peeks, or go premium for joint edits.

Any tips for newbies?

Start with voice for speed, then tweak sorts as your patterns show up.

AI Accounting Assistant , AI Research Tool , AI Productivity Tools , AI Task Management .

These classifications represent its core capabilities and areas of application. For related tools, explore the linked categories above.

Vossa App details

This tool is no longer available on submitaitools.org; find alternatives on Alternative to Vossa App.

Pricing

- Free

Apps

- Web Tools

- iOS Apps

- Android Apps