🧠 AI Quiz

Think you really understand Artificial Intelligence?

Test yourself and see how well you know the world of AI.

Answer AI-related questions, compete with other users, and prove that

you’re among the best when it comes to AI knowledge.

Reach the top of our leaderboard.

wokelo ai

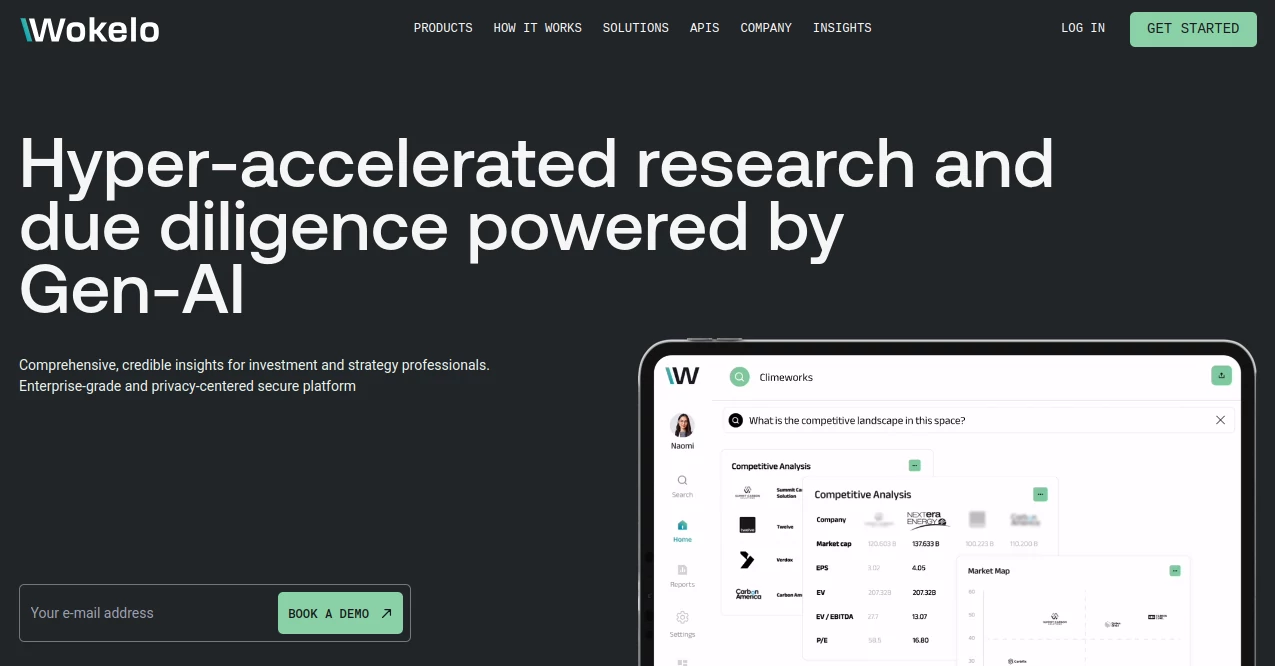

Human-Like Research at Lightning Speed

What is wokelo ai?

Wokelo hands investment pros a secret weapon that turns weeks of digging into minutes of insight, pulling together scattered facts into polished reports that read like a seasoned analyst wrote them. Private equity teams, bankers, and strategy leads lean on it daily to size up companies, map markets, and spot risks before committing big dollars. What started as a quiet fix for burned-out researchers has snowballed into the go-to hub for anyone who needs bulletproof answers without the all-nighters.

Introduction

Back in 2022 a Seattle crew tired of copy-paste marathons built Wokelo to do the heavy lifting, training custom agents on millions of real-world examples so they think like humans but work like machines. Word spread fast through fund hallways and deal rooms—suddenly junior analysts were delivering partner-level decks before lunch. Today it serves top-tier funds and corporates, quietly powering decisions worth billions while keeping every search locked down tighter than a vault. Users keep coming back because it doesn’t just spit data; it tells the story behind the numbers, complete with sources you can actually trust.

Key Features

User Interface

You land on a clean dashboard that feels more like a smart inbox than a data dungeon. Type a company name or sector question, hit enter, and a live thread builds the answer right in front of you—sources popping in as citations, charts sliding into place. Side panels let you nudge the angle (“focus on competitive moats” or “add financial projections”) without ever leaving the page, and one-click exports drop perfect slides or memos into your drive.

Accuracy & Performance

Trained on over ten million fine-tuned examples, the agents nail nuance—spotting subtle regulatory shifts or hidden supply-chain risks that generic models gloss over. Reports clock in under five minutes for even complex asks, yet read like they took days. Users routinely fact-check the output against internal decks and find Wokelo caught details they missed, saving embarrassing rewrites at the eleventh hour.

Capabilities

Ask anything from seed-stage founder backgrounds to post-IPO growth drivers and get structured sections: market sizing, player profiles, financial tear-downs, risk flags, and upside scenarios. It triangulates news, filings, patents, and earnings calls in one sweep, then formats the deliverable exactly how you like—bullet slides, long-form memos, or CSV tables. Need a custom model for your fund’s secret sauce? Spin one up in a weekend.

Security & Privacy

Enterprise-grade from day one: SOC 2, GDPR, HIPAA compliant, with end-to-end encryption and zero data retention beyond your session unless you save it. Queries never train public models, and you can wipe everything with one click. Big funds sleep easy knowing no competitor will ever see their deal pipeline.

Use Cases

PE associates screen a dozen targets every morning, surfacing red flags before the partner even opens the deck. Bankers prep pitch books overnight, turning vague MD requests into 40-page beauties by sunrise. Corporate dev teams map adjacent markets in an afternoon, arming the board with numbers that hold up under fire. Even solo VCs use it to pressure-test founder narratives in real time during Zoom calls.

Pros and Cons

Pros:

- Cuts research time by 80% without cutting corners.

- Outputs look and feel human—partners can’t tell the difference.

- Ironclad sources baked into every claim.

- Custom agents let power users build proprietary edges.

Cons:

- Steepest power locked behind team plans.

- Still learning ultra-niche private-company data gaps.

- No mobile app yet—best on desktop for heavy lifts.

Pricing Plans

Jump in with a 30-day full-feature trial, no card required. Solo pros pay $50 a month for unlimited quick hits. Teams start at $299 monthly for shared libraries and custom agents, scaling with seats. Annual deals knock 20% off, and big shops negotiate bespoke packages with dedicated support and on-prem options.

How to Use Wokelo

Sign up, verify your work email, and paste your first question—“Give me a due-diligence memo on Acme Corp’s SaaS pivot.” Watch the thread build live; click any citation to verify. Tweak with follow-ups (“add peer comps” or “highlight regulatory risk”). When it’s perfect, export to PowerPoint, Word, or PDF with one click. Save winning prompts to your team library and reuse forever.

Comparison with Similar Tools

Free ChatGPT spits walls of text with shaky sources; Wokelo delivers board-ready decks with footnotes. AlphaSense drowns you in filings; Wokelo synthesizes the story. Capitol AI does quick news blasts; Wokelo builds full investment theses. Bottom line: if you need client-facing work that survives partner scrutiny, this is the one that ships.

Conclusion

Wokelo doesn’t replace analysts—it supercharges them, freeing nights and weekends for the real art of deal-making. Funds that adopt it early widen their moat; those that wait hand the edge to competitors. In a world drowning in data, the winners will be the ones who tame it fastest—and Wokelo is the sharpest lasso in town.

Frequently Asked Questions (FAQ)

Does it hallucinate like regular chatbots?

Far less—every claim carries a live source you can click.

Can I query private companies?

Yes, it surfaces news, filings, and third-party intel available publicly.

What file formats can I export?

PPTX, DOCX, PDF, CSV, or raw JSON for your internal tools.

Is my data ever used to train the model?

Never—strict zero-retention policy unless you opt in.

Can I bring my own data sources?

Enterprise plans let you plug proprietary databases for extra edge.

AI Research Tool , AI Consulting Assistant , AI Investing Assistant , AI Analytics Assistant .

These classifications represent its core capabilities and areas of application. For related tools, explore the linked categories above.

wokelo ai details

This tool is no longer available on submitaitools.org; find alternatives on Alternative to wokelo ai.

Pricing

- Free

Apps

- Web Tools